The Emerging ‘AI Native’ Playbook

Opportunities for Founders and Investors

Introduction

AI is sparking big questions in the startup world. Is this a golden age for founders, with AI opening new doors for breakthrough companies? Or is it pushing startups toward a future of commoditization, where it’s harder to stand out and stay relevant as AI advances quickly?

As a founder and investor in AI applications, I’m increasingly convinced that generative AI gives rise to a promising new class of companies: 'AI Native' startups.

In this piece, I explore what makes these companies distinct and why incumbents struggle to adopt this model. I’ll dive into how AI Native startups build defensibility, what sectors are ripest for AI-driven disruption, buy vs. build strategies, and what these changes mean for founders, investors, and the job market.

Want the tldr? Check out the X summary here.

The Rise of AI Native Companies

Generative AI is transforming creative and knowledge work—making it faster, more affordable, and more accessible than ever before. This technology lays the foundation for a new kind of company that incumbents will struggle to replicate.

What Makes a Company ‘AI Native’?

Direct Delivery of Work

AI Native companies deliver work directly to customers, using AI to efficiently complete tasks autonomously or semi-autonomously (”ask-and-adjust”). This approach is distinct from SaaS, which enables users to do their own work, and traditional services companies, which deliver work using large teams of people.

Example: Sierra (an AI Native company) uses AI agents to resolve support requests autonomously, helping clients scale without adding headcount. By comparison, Zendesk (SaaS) enhances human agents with productivity tools, and Teleperformance (services) depends on large teams of people for customer support.

Work-Based Pricing

AI Native companies frequently use work-based pricing, charging customers based on work delivered rather than labor or access. This model better aligns incentives between the vendor and the customer, with costs tied to results.

Example: Sierra charges per successful support resolution, while Zendesk typically charges ‘per seat’ and Teleperformance often charges based on staffing.

“Goals and Guardrails” Tech Architecture

AI Native companies replace rule-based systems with flexible “goals and guardrails” architectures that let AI make decisions within boundaries. This transforms the user experience from rigid workflows that enable users to dynamic interfaces that complete actions for the customer.

Example: Sierra uses goal-driven AI to autonomously handle customer issues. Zendesk relies on rule-based workflows, while Teleperformance uses tools like Zendesk but still depends heavily on human labor.

Ultra-Lean Operations

AI-enabled automation allows AI Native companies to scale with minimal labor costs, running much leaner than traditional service models.

Example: Sierra operates efficiently with minimal staff, while Teleperformance employs over 400,000 people, and Zendesk requires clients to manage their own support teams.

Expanded Market Opportunity

By offering accessible, affordable services, AI Native companies reach beyond traditional software budgets, tapping into and expanding the larger services market.

Example: Sierra taps into customer support budgets, and can eventually reach businesses that couldn’t previously afford 24/7 support, thus expanding the market. By contrast, Zendesk is limited to software budgets, and Teleperformance serves only the existing market without broadening access.

From Rules to “Goals and Guardrails”: A New Product Paradigm

AI Native companies are built around goal-oriented AI systems, a dramatic shift from rule-based software. Instead of relying on fixed workflows, these products are centered on probabilistic AI agents that pursue specific goals within defined guardrails. This is not just an “AI layer” added to existing products; it’s a complete rebuild of the product’s architecture and user experience to maximize AI’s capabilities. Think of it as a leap similar to moving from on-premise software to the cloud, transforming user expectations and redefining what software can deliver.

‘Everyone Becomes a Manager’: AI User Interfaces

In AI Native products, users essentially become managers with two main types of interfaces that redefine user roles:

Ask-and-Adjust Interfaces: Users request outputs from AI and make adjustments as needed—similar to a manager delegating tasks.

Example: A lawyer asks Harvey’s AI to draft a contract and refines the output.

Autonomous AI Agents: Users supervise multiple AI agents working independently, stepping in only for complex cases, much like managing a team.

Example: A customer support lead monitors Sierra’s AI agents that handle routine inquiries, intervening only in unique situations.

At first, ask-and-adjust interfaces will likely be more common, especially in high-stakes scenarios. But as AI advances, direct oversight will decrease, with humans shifting to occasional monitoring and handling unique cases. Eventually, AI will manage end-to-end workflows, with humans primarily focusing on high-level oversight.

Why Services and SaaS Companies Struggle to Go AI Native

If AI Native companies deliver superior, cost-effective, and instant services, why won’t incumbents just replicate this model? Because it’s very disruptive to their business!

Disruptive Pricing Models (Counterpositioning)

AI Native startups usually charge for work done—such as per conversation or per successful resolution—while traditional SaaS and services models are built around per-seat or per-hour pricing. Shifting to work-based pricing can disrupt the core revenue models for incumbents, potentially reducing their revenue and affecting everything from sales commissions to revenue forecasting.

Competing with Your Customers

For incumbents, adopting AI Native models can mean competing directly with their own customers. For example, AI-powered customer support can reduce the need for customer support agents, potentially alienating SaaS companies’ core users.

Product Overhaul

Moving to an AI-driven architecture requires abandoning rule-based workflows in favor of flexible “goals and guardrails.” This shift is as disruptive as the transition from on-premise software to the cloud, often rendering existing products obsolete or tech debt.

Organizational Transformation

AI Native companies are lean and automation-focused, while traditional services rely heavily on labor. For incumbents to adapt, they would need to overhaul their culture, workforce, and cost structures—an enormous shift that few are prepared to make.

While established companies have resources and distribution advantages, AI Native startups are more agile and free from legacy systems, enabling them to more quickly create better solutions.

What Makes AI Native Companies Defensible?

The defensibility of AI Native companies primarily comes from switching costs that they develop over time, in addition to traditional moats:

Switching Costs from Deep System and Workflow Integration

AI Native companies can increase defensibility by raising switching costs through integration into customer’s systems and workflows over time. Take Didero, for example: it enters the market by managing purchase orders—a low-friction way to onboard customers. Over time, it expands into sourcing, negotiations, and payments, requiring access to email, accounting, and contract systems, along with a UI to oversee the process. Eventually, Didero could replace the systems of record entirely. As its value and integration deepen, customers become increasingly reliant on the platform, making switching less attractive. However, it's worth noting that AI-driven automation can also reduce implementation costs, potentially weakening this moat.

Quick Test: “Would a 100x improvement in OpenAI’s models benefit or threaten this company?” If it threatens them, they likely need to tackle an even meatier job-to-be-done that requires deeper integration.

Switching Costs from Deep Personalization (”Memory”)

AI systems that personalize based on a user’s history deliver unique value that’s hard to replicate. For instance, an AI therapist that tailors its responses based on months of conversations, or an AI sales agent that hones its approach based on what works for a specific client’s prospects, delivers client-specific insights that competitors can’t easily replace.

This defensibility is strongest when customer variability is high and customer history drives results. This personalized knowledge forms a “memory” that’s difficult to transfer, making switching to a new provider less attractive.

Other Traditional Moats

As AI Native companies mature, they can also benefit from traditional defenses, such as network effects and brand loyalty. In heavily regulated industries like healthtech and insurtech, AI Native businesses can also benefit from scale economies by spreading the high costs of regulatory compliance across more customers, adding an additional layer of defensibility.

Overhyped Defenses

Software Alone: With generative AI reducing development costs, software alone is no longer a strong moat.

Proprietary Datasets: Unique datasets in a category, like radiology images or legal contracts, are often seen as a moat. However, their value may diminish as generalized AI models trained on diverse data achieve similar accuracy. A better moat is a closed-loop system that continuously captures client-specific outcome data and history to deliver customer value that is difficult to replicate.

Custom Reasoning: Custom reasoning techniques, like advanced prompt engineering, serve as necessary short-term fixes to address limitations in current language models, but are unlikely to provide lasting defensibility. As foundational models improve their reasoning capabilities, these custom cognitive architectures will deliver less value over time.

Going Upstream: How Startups Can Become the New Systems of Record

In some cases AI Native startups can leverage a unique advantage: they can capture data at its source—often before it even reaches legacy systems like Salesforce. This allows them to begin as middleware solutions that integrate with existing platforms and can potentially replace them in the future.

Here are some examples:

Liberate (Insurance): Through AI voice agents, Liberate captures claims data directly during customer interactions. Initially, it integrates with legacy platforms like Guidewire, but by controlling the data flow, it can gradually replace them.

11x (Sales): 11x automates lead generation by capturing data from emails and messages directly, bypassing the need for traditional CRMs like Salesforce.

Fixify (IT Services): Through an AI-powered chat interface, Fixify handles IT issues at the customer interaction point, positioning itself to eventually replace legacy helpdesk systems like ServiceNow or Zendesk.

By owning data close to the customer or source of truth, these startups reduce the risk of disintermediation, setting the stage to phase out incumbents over time.

“But There Are So Many Competitors—How Can Any Company Be Defensible?”

The AI Native landscape is still emerging, with relatively low barriers to entry and a wave of new startups entering the space. This has led to a period of rapid market entry. As the market matures, companies that secure deep integrations and personalized relationships with customers will raise switching costs and reduce turnover, making it harder for competitors to displace them. We may also see consolidation, as smaller solutions struggle to compete.

In this environment, where vendors build stickiness after landing a customer, some may pursue a land grab strategy: raising capital and deploying an aggressive go-to-market approach to secure a foothold and potentially create lasting advantages.

Example: EvenUp, a legaltech startup in personal injury law, has embraced this strategy. They were first to market but have seen fast followers emerge. To stay ahead, they raised over $180M in two years, signaling their ambition and building a war chest to dominate their niche.

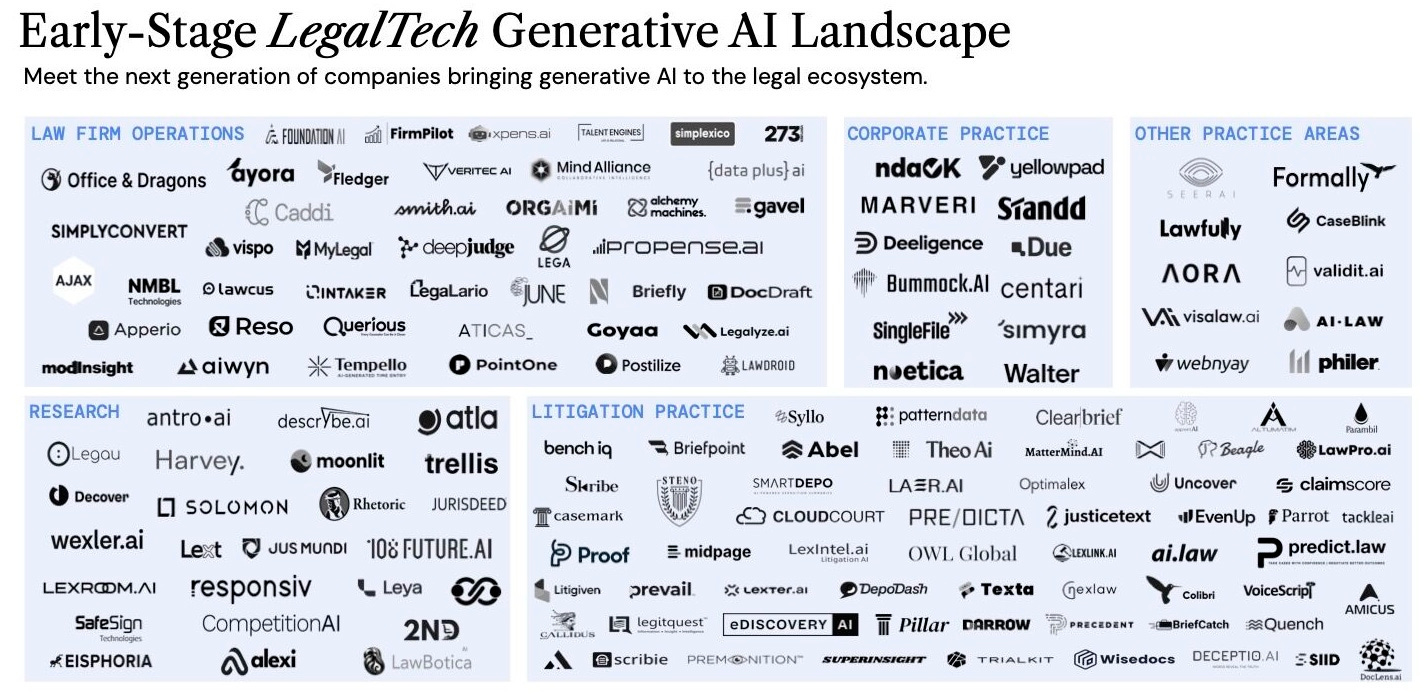

An overview of more than 100 generative AI companies in legal tech, highlighting the intense competition within the early AI Native market. (Source: LegalTech Fund. June 2024)

Choosing the Right Team

While this framework helps identify promising concepts and markets, the crucial decision often comes down to which team to back when multiple startups are pursuing similar ideas. Evaluating the founding team requires a mix of intuition and analysis, balancing insights into the founders' vision, domain expertise, and execution capabilities. Here are additional factors that founders and investors can consider:

Strategic Vision and Clarity: Founders who have deeply considered these strategic questions—such as how they’ll build defensibility over time while driving toward a big vision—demonstrate a clarity of thought that’s particularly compelling. This level of foresight often suggests a stronger likelihood of long-term success.

Proprietary Access and Partnerships: Teams with unique distribution channels or partnerships can gain an edge. For example, Abridge’s partnership with Epic to provide AI scribe services grants them proprietary access, potentially enabling faster growth during the early land-grab phase.

Niche Differentiation: In some markets, multiple players can succeed by specializing in specific niches, especially if there are unique compliance requirements or other needs for domain expertise. For instance, while Sierra and Liberate both offer AI-driven customer support, Liberate focuses on the insurance industry, integrating with platforms like Guidewire. This targeted approach allows it to deliver specialized value, strengthening defensibility within its niche.

Where AI Native Adoption May Be Fastest

AI Native companies may see faster adoption than previous tech revolutions due to a key advantage: they deliver familiar services with new benefits like increased accessibility, affordability, or speed. Generative AI’s use of natural language also reduces the learning curve, making these solutions easier to integrate. Combined with the ability to tap into broader service markets rather than just IT or software budgets, this might help explain why AI startups are scaling faster than their SaaS predecessors.

Companies adopting a “land and expand” approach—starting with simple use cases and gradually deepening integration—are especially positioned for rapid adoption, building defensibility and long-term value through incremental expansion.

Adoption may be particularly rapid in sectors where AI isn’t replacing employees but is instead filling labor gaps, replacing outsourced roles, or expanding access to new markets.

Sectors with Labor Shortages

In industries like healthcare, where labor is scarce or turnover is high, AI offers a scalable solution to bridge workforce gaps. For example, AI-powered healthcare scribes like Abridge automate documentation, allowing doctors to focus on patient care and boost productivity.

Outsourcing-Heavy Industries

Sectors accustomed to outsourcing, like business process outsourcing (BPO), are well-suited for AI integration. For instance, AI customer support agents can handle routine inquiries with 24/7 support, reducing reliance on large outsourced teams.

New Markets

AI also opens up new markets by making advanced services accessible for new customer segments and enabling entirely new experiences, as described below.

Expanding the Market with AI: Beyond the Lump of Labor Fallacy

The belief that AI will simply replace jobs assumes a fixed amount of work and overlooks how AI can expand the market by making high-quality services accessible to more customers and creating entirely new use cases. In an AI-driven world, every small business can run like an enterprise, and more people can access goods and services previously limited to the few. This creates a unique growth opportunity for startups:

Increased Utilization: AI-driven tools allow customers to perform tasks more frequently and affordably. XBOW’s AI penetration testing, for instance, enables continuous security monitoring rather than reserving pentesting for quarterly compliance checks.

Access for New Customer Segments: By lowering costs, AI allows downmarket businesses or customers to benefit from previously exclusive services. Valence, an AI executive coach, provides personalized coaching to mid-level employees who previously lacked access to these resources; and Assort enables midsize medical practices to offer an enterprise-grade call center so patients can contact their practice, 24/7.

New Use Cases in Enterprise and Consumer Applications: AI also creates entirely new opportunities, particularly in creative and knowledge-based applications. Suno, a consumer AI music platform, lets users create and consume personalized music, democratizing high-end music production.

Identifying Promising AI Native Companies: A Case Study

Let’s return to Didero, an AI-powered procurement agent, as a case study. Here are a few questions one can ask to examine a company’s defensibility and growth potential.

1. “Is the company tackling a high-value, enduring job-to-be-done?”

The first question is whether the company addresses a “job to be done” that will remain valuable and persistent as AI reshapes the landscape.

Application to Didero: The company’s focus—procurement—is a critical business function with direct impact on revenue and operations, making it unlikely to lose relevance.

Contrast: Some tasks, like prompt engineering, are expected to become less critical over time as AI improves. Companies focusing on short-term needs should be able to explain why their near-term focus sets them up for a broader vision that is more enduring.

Ask yourself: Is the company solving a lasting problem, or addressing a temporary need?

2. “Does the company increase switching costs by embedding more deeply over time?”

The most defensible AI Native companies handle complex tasks that require deep integration across customer systems and workflows, raising switching costs over time.

Systems Integration: Didero initially focuses on managing purchase orders to facilitate quick adoption. Over time, it aims to evolve into an end-to-end procurement agent, managing supplier relationships, contract negotiations, and payment processing. This requires integration with customer email, purchasing, payment, and accounting systems.

Workflow Integration: Becoming part of a customer's daily operations creates “stickiness.” By offering user-friendly dashboards or interactive tools, Didero can become a “sticky” daily-use platform, making it hard to replace.

Ask yourself: Would a 100x improvement in OpenAI’s model benefit this company? For Didero, the answer is yes—improvements would enhance its ability to manage end-to-end procurement.

3. “Does the company drive higher switching costs by personalizing over time?”

Products that deliver more user value over time by personalizing based on a user’s history and outcomes data have higher defensibility, particularly in sectors with high customer variability.

This may be the case for Didero, although it’s not as obvious as in the case of, say, an AI therapist.

Ask yourself: Does this company’s AI get better with as it gets to know the customer, particularly in ways unique to each customer?

4. “Is the company upstream of incumbents and closer to the customer or source of truth?”

AI Native companies that capture data at the source of customer interaction can gain an advantage by owning the flow of information, positioning them to replace downstream systems over time.

Didero captures procurement data directly from customer communications, giving it a position to displace systems like SAP Ariba in the future.

Ask yourself: Is this company controlling data at the source, or is it downstream and more vulnerable to displacement?

5. “Does the company have a business model that incumbents can’t easily replicate?”

Startups can take advantage of counterpositioning, or improved business models that are harder for incumbents to replicate.

For instance, SAP may hesitate to offer a Didero-like service, as it could cannibalize its existing seat-based revenue from their Ariba SaaS product.

Ask yourself: Can this company offer something that incumbents can’t without disrupting their own business model?

6. “Is the company serving a sector with a labor shortage or unlocking new demand?”

AI solutions may see faster adoption in sectors where they aren’t merely replacing employees but are filling labor gaps, replacing outsourced roles, or expanding access to new markets.

Didero targets midmarket companies with stretched procurement resources, meeting an acute labor shortage need.

Ask yourself: Is this company filling a critical resource gap or unlocking new opportunities beyond simple labor replacement?

7. “Does the company have traditional moats like network effects?”

While AI has shifted the tech landscape, traditional moats like network effects still provide valuable defenses.

For Didero, as more manufacturers join, it can leverage group purchasing power to negotiate better terms with suppliers. This growing network could eventually support a two-sided marketplace, enhancing value for both manufacturers and suppliers.

Ask yourself: Does this company have traditional moats like network effects that will help defend its position over time?

While a high-potential AI Native company doesn’t need to check every box, it’s crucial that they address a lasting, valuable need (question 1) and increase switching costs through deep integration or personalization.

The questions above are just a few questions that one can consider when assessing the concept, in addition to other key questions related to team (see Choosing the Right Team).

Key Takeaways

AI is Transforming the Services and SaaS Industries

AI Native companies present a unique opportunity to tap into—and expand—the multi-trillion dollar services sector. These companies deliver services autonomously or semi-autonomously, with pricing based on results rather than labor or access. Built on a foundation of “goals and guardrails” architecture, their tech stack and UX are fundamentally different from traditional software, allowing them to operate with greater efficiency and flexibility.Early Industry Dynamics Create a ‘Land Grab’ Opportunity

The AI Native landscape is still in its infancy, with many startups offering minimally viable products. This has created a “land grab” phase, where companies are racing to establish a foothold. Over time, leading players are likely to build stickiness by raising switching costs with deep customer integrations and customer-level personalization, in addition to other traditional moats. (Software alone, data, and generic architectures are unlikely to provide long-term defensibility). Sectors primed for rapid adoption are those where AI can fill labor shortages, replace outsourced roles, or open access to new markets rather than directly replacing employees.Considerations for Founders: Build Moats and Move Upstream

Founders should move quickly (while maintaining quality) to capture market share during this early ‘land grab’ phase, and then invest in building defensibility over time. Effective strategies include:Raising Switching Costs by expanding the product scope and integrating more deeply with customer workflows and systems (‘land and expand’), along with using deep personalization (“memory”) to improve customer outcomes.

Leveraging Traditional Moats like network effects, while understanding that custom reasoning or software offers only temporary defensibility.

Going Upstream of Incumbents to capture valuable data and customer interactions—an approach that can position AI Native companies to eventually replace legacy providers.

Considerations for Investors: Assess Strategic Vision and Moats

In addition to traditional team-assessment criteria, investors should prioritize teams with a clear, strategic vision for how they are solving a high-value, persistent problem. The strongest teams can articulate how they’ll build defensibility and continuously add value for users over time.

Appendix

Pricing for AI Native Companies

AI Native companies can capture more value than traditional “seat-based” software models, which often capture only 10-15% of the value they create. By charging based on work done, rather than per user or license, AI Native companies better align with customer needs, allowing customers to scale as they realize more value from the product.

Two Main Approaches to Work-Based Pricing

Usage-Based Pricing

In usage-based pricing, customers pay based on the amount of work delivered, typically within usage tiers. The benefit of tiered pricing over a direct ‘per unit’ model is that it provides predictable costs for both the company and the customer and it encourages consistent engagement without concern over each additional use.

Example: Pricing might be $300/month for up to 500 conversations and $450/month for 501 to 1000 conversations.

Success-Based Pricing

With success-based pricing, customers pay only when the product achieves specific results, like resolved conversations or qualified leads. This model works best if (1) you control the end-to-end process, and (2) there’s a clear, agreed-upon definition of success.

Example: Intercom’s AI support tool charges only for resolved conversations, which are defined by customer confirmation (hard resolution) or when customers leave a conversation without returning within 24 hours (soft resolution).

Implications of Work-Based Pricing vs. Seat-Based Pricing

Switching to work-based pricing has several implications for AI Native companies:

Focus on Post-Sale Success

With work-based pricing, success only begins after the contract is signed. Unlike traditional models where users may not actively engage, AI Native companies need customers to consistently use the product to generate value. This approach requires robust product design and ongoing customer support to drive engagement.

Complex Sales Compensation

Compensating sales teams can be more complex under usage-based pricing. Some companies, like AWS and Snowflake, address this by compensating sales reps based on actual customer usage, aligning incentives with customer success and product engagement.

Making Work-Based Pricing Predictable for Customers

Traditional procurement teams often prefer predictable bills, so it’s crucial to make usage-based pricing manageable. Using tiered pricing, as mentioned above, can help provide predictability while capturing value as usage grows.

Setting the Right Price

To set an effective price, use two key benchmarks: customer value as the price ceiling and replacement cost as the price floor:

Customer Value as the Price Ceiling: Estimate the dollar value your AI product provides to the customer and aim for a 3:1 ROI for customers—meaning they receive three times the value they pay. This lets you capture about 25% of the total value created, offering clear value for customers while ensuring a fair return for your company.

Replacement Cost as the Price Floor: Consider the cost of achieving similar results through non-AI means, like hiring staff or outsourcing. This cost serves as a floor for pricing. Ideally, your AI solution should provide benefits beyond labor replacement, such as faster performance, 24/7 availability, and higher consistency, which can justify a premium.

Together, these benchmarks help you set a price that is competitive, reflects the value delivered, and positions your AI solution as a high-value choice.

Working on an AI Native company?

Join the free, invite-only AI Natives Community—a space for people actively building AI applications to share advice, trade recommendations, and stay current with the latest in AI.

What Will AGI Mean for AI Native Startups?

Some predict that AGI may be achievable within the next few years. While no one knows for certain, AGI would undoubtedly impact the business landscape. Here’s a potential framework for what an AGI-driven future might look like and why AI Native companies should remain relevant.

Consider how a well-resourced executive manages their work and personal life:

A Personal Assistant manages their personal tasks and keeps life organized.

A Chief of Staff provides leverage in their professional life.

Specialized Teams handle ongoing functions, like sales, marketing, and customer support.

In a world with AGI, these structures might be accessible to everyone:

Personal Home Agent: This would be the AI equivalent of a personal assistant, managing day-to-day tasks with knowledge of an individual’s personal context. Tech giants like Apple and Android, which already have a strong foothold in consumer AI, are well-positioned to develop such agents, although there may be room for new players too.

Personal Corporate Agent: At work, each person might have a corporate AI agent that manages tasks and integrates into company systems—imagine getting assigned your Corporate Agent on Day 1 of a new job. Established platforms like Microsoft and Salesforce have a head-start to win in this space thanks to their integrations with corporate environments and interface with most employees at a company.

Function-Specific Agents: Specialized agents in sales, marketing, procurement, etc., would continue to directly support functional leaders. AI Native companies focused on “meaty, persistent jobs-to-be-done” in these domains are likely to retain value even as AGI advances.

In this scenario, AI Native companies working on high-value business functions would continue to be essential, acting as scalable, specialized resources that augment human capability.

Buy vs. Build

If you’re convinced of the opportunity to deliver AI-powered services, the question naturally arises: is it better to start from scratch or acquire an existing services business and transform it? To answer, it’s helpful to consider what you’re actually buying when you acquire a company.

Here are three potential reasons why buying a business might be attractive:

Distribution: In sectors with long sales cycles or where customers have lengthy commitments, acquiring existing contracts can accelerate growth. This is particularly useful if you’re selling a "rip and replace" solution, where winning over customers typically takes time.

Domain Expertise: In highly specialized fields, acquiring expertise through an existing business could bridge any gaps on your team.

Data: If certain high-value data is crucial to get started or significantly boosts your company’s growth, acquiring a company with that data might be valuable.

That said, for most founders and VCs, building from scratch with an experienced team may be the better approach. Here’s why:

Distribution: Buying distribution, while potentially accelerating growth, can be expensive and limit your upside, making it more of a private equity strategy. If you acquire a large company, change management becomes complex, again resembling more of a PE play. A smaller acquisition may provide some advantage, but partnering with a few strategic development partners can be more effective.

Alternative: In many cases, you can accelerate sales by going upstream and offering a service customers don’t yet have (e.g., like Liberate), or running a shadow process that demonstrates parity or value—such as a parallel process to prove your solution before a customer commits.

Domain Expertise: Instead of acquiring a company, you can often bring in domain experts directly onto your team. Buying a company with a strong culture rooted in specific expertise could lead to resistance to change—exactly the opposite of what AI Native companies need to succeed.

Data: Before buying a company for its data, ask if you truly need to own the company to access the data. In many cases, you can obtain it through design partnerships or open sources. For instance, medical billing data can often be gathered from publicly available coding standards, payer websites, or directly from customers. There are niche cases where buying data may be essential (e.g., proprietary industrial sensor data), but for most AI Native applications, data acquisition doesn’t necessitate buying an entire business.

What Does All of This Mean for Jobs?

AI Native companies are likely to reshape the workforce, bringing both near-term disruptions and potential long-term opportunities.

Short-Term Job Disruption: In the near term, AI-driven automation may reduce certain roles, particularly in labor-intensive areas like customer support. Companies such as Teleperformance, with large workforces, could face workforce adjustments that impact many lives. Supporting those affected through thoughtful policies and resources will be essential as these changes unfold.

Long-Term Transformation: Over time, as explored in the “Lump of Labor Fallacy” and “Everyone Becomes a Manager” sections, AI could expand market demand and shift human roles towards oversight and strategic guidance. This gradual evolution may create new opportunities for people to work alongside AI and ultimate return to a new equilibrium with full employment, as has been the case with prior technology revolutions.

Defensibility in the AI Era

Hamilton Helmer’s "7 Powers" framework outlines the core sources of competitive advantage for businesses. While generative AI hasn’t changed these fundamentals, it has shifted the strength of some factors for incumbents. Here’s a look at how each “Power” holds up in an AI-driven world:

Scale Economies: A business where per-unit costs decrease as volume increases (e.g., Netflix).

AI Impact: AI diminishes scale advantages by lowering upfront costs for building products and delivering services. Startups like Suno, which automate content creation, can now challenge larger players by producing content without the need for massive budgets. In software, AI lowers the barriers to developing and maintaining complex codebases, making it easier for new entrants to compete.

Counter Positioning: When a new business model outperforms incumbents, who resist adopting it to protect legacy revenue (e.g., SaaS vs. on-prem software).

AI Impact: AI opens new opportunities for startups to adopt disruptive models, such as work-based pricing over traditional subscriptions. Incumbents may hesitate to adopt these models if it means cannibalizing their existing revenue streams, allowing AI Native startups to outpace them.

Network Effects: A business where customer value increases as the user base grows (e.g., Facebook, marketplaces).

AI Impact: Largely unchanged. Strong network effects continue to be valuable, but AI can shift user behavior and the ways people interact with platforms. For example, if Apple’s AI becomes the default personal agent, it could draw users away from platforms like Yelp. AI can also simulate user interactions to enhance platform value.

Switching Costs: Costs that make it unattractive for customers to switch to a competitor (e.g., Salesforce).

AI Impact: AI can both increase and reduce switching costs. Deep integrations with customer workflows can create strong switching barriers. However, AI can also simplify transitions by automating data migration and setup, potentially lowering switching costs for customers considering new solutions.

Branding: The perceived value and trust built by a company through brand equity (e.g., Coca-Cola).

AI Impact: Branding becomes even more valuable as AI leads to a proliferation of new competitors. In a world flooded with AI solutions, established brands benefit from customer trust, serving as a safe choice amid uncertainty.

Cornered Resource: Exclusive access to valuable resources that enhance a product’s value (e.g., proprietary data sets).

AI Impact: Mixed. AI can sometimes erode the value of proprietary data by generating new data or insights. However, in certain cases—such as access to unique, non-public data—this advantage remains strong. For example, rare industrial or pricing data could still provide a significant edge.

Process Power: Superior processes that enable a company to deliver better products or services at lower costs (e.g., Toyota’s lean manufacturing).

AI Impact: Varies by industry. In domains with complex processes, incumbents may still leverage process power. However, AI enables new entrants to build efficient, modern processes without being encumbered by legacy systems, offering an opportunity to outmaneuver incumbents.

In the AI era, the balance of competitive power is shifting. While not all incumbents will be displaced, the weakening of traditional advantages like scale economies and counter-positioning creates space for AI Native companies to build defensible positions. By understanding these shifts, founders and investors can better assess where new opportunities lie and how to build lasting value in a rapidly evolving landscape.

Sample of AI Native Companies

See here for a full market map of AI Native companies.

Counter-Arguments

As with any transformative change, there are valid counterpoints and skepticism around the AI Native opportunity. Here, we’ll address some common critiques.

“The ‘AI Native’ advantage is overstated; incumbents will adapt.”

Counter: This view underestimates the depth of change required for incumbents to shift to AI Native models, which involves foundational, not incremental, transformations:

Counterpositioning: Moving from subscriptions or hourly pricing to work-based pricing requires rethinking unit economics and redesigning the entire business model. Additionally, fully embracing AI Native services could require some companies, like Zendesk (SaaS), to alienate their customers.

Technical Overhaul: Transitioning from rule-based systems to probabilistic “goals and guardrails” AI demands a complete technical rebuild and a new user experience.

Organizational Transformation: Embracing automation requires major shifts in personnel and culture, which can be challenging for companies reliant on large teams.

Historical Parallel: On-premise software companies that failed to transition to the cloud serve as a cautionary example—only a few adapted fully.

“Launching an AI Native company can be as simple as making an API call. With startup competition surging, won’t the economics degrade as companies struggle to stand out?

Counter: While access to foundational models is more democratized, defensibility for AI Native companies lies in increasing switching costs over time through deep system and workflow integrations and personalization, in addition to traditional moats like network effects. (See “What makes AI Native companies defensible?”) Additionally, the industry is currently in an early, land grab phase as low startup costs allow many entrants to offer basic solutions. However, as the market matures, companies that build out their solutions to add more value and deeply integrate and personalize for customers will raise switching costs and improve retention.

“AI Native companies won’t have a cost advantage because inference is expensive.”

Counter: Inference costs are declining quickly due to rapid technological improvements and increased competition among foundational model providers. We’re seeing cost-per-inference drop regularly, a trend that should continue as the technology scales.

“Market expansion is overhyped; customers still prefer human services.”

Counter: Historically, making technology more accessible tends to expand markets. AI democratizes services that were once considered luxuries—like legal, medical, and cybersecurity services—by making them affordable for the masses. Additionally, “ask-and-adjust” interfaces allow users to leverage AI without sacrificing human involvement when needed, easing the transition.

“This whole framework overstates how advanced AI technology is.”

Counter: While true AGI may be distant, current AI systems are already delivering the benefits described here. In high-risk areas, “ask-and-adjust” models will likely dominate for now, but as models improve, more tasks will be automated without the need for major technological breakthroughs.

“When AGI comes, none of this will matter.”

Counter: Even in a post-AGI world, the companies that handle persistent, meaty tasks like sales, marketing, and procurement will continue to thrive. AGI will enhance personal agents, corporate assistants, and function-specific agents, but AI Native companies already embedded within core workflows are likely to retain a strong foothold.

Enjoy this article? Like it and subscribe.

AI Natives offers practical insights and strategies for founders and investors building AI Native companies. Interested in contributing a post? Reach out!

Thank you to:

Thanks to many people for providing early feedback and inspiration for this playbook, including but not limited to: Alex Moskowitz, Barak Kaufman, Joe Teplow, Jacob Effron, Sarah Tavel, Kyle Poyar, Zach Lloyd, Arash Afrakhteh, and Joe Schmidt.

Super thorough and well written!